Mallorca Luxury Property Investment: Stability and Growth

· 4 min. read

Mallorca Real Estate: Stability, Lifestyle, and Long-Term Growth

Mallorca continues to stand out as one of Europe’s most desirable destinations for real estate investment. Combining lifestyle appeal with strong market fundamentals, the island offers a balance of capital preservation, moderate growth, and lifestyle benefits.

For investors wondering whether buying a property in Mallorca is a safe investment, the answer is yes — provided you select the right asset, plan for a medium-to-long holding period, and ensure full compliance with local regulations.

Why Mallorca? The Market Fundamentals

Mallorca’s enduring popularity is underpinned by three pillars: infrastructure, scarcity, and lifestyle appeal.

- Year-Round Connectivity: Palma Airport links to over 170 international destinations.

- Healthcare & Education: Top-tier hospitals and prestigious international schools serve both residents and second-home owners.

- International Buyer Base: Strong demand from Germany, the UK, Nordics, and a growing interest from North America and the Middle East.

- Supply Constraints: Strict zoning, UNESCO-protected landscapes, and heritage restrictions keep inventory growth below 1% annually.

- Lifestyle Ecosystem: Golf, sailing, gastronomy, and wellness make Mallorca a year-round luxury destination.

These fundamentals position Mallorca real estate in 2025 as one of the most resilient luxury markets in Europe.

Investment Profiles: Choosing the Right Strategy

Every investor’s path looks different, but most fall into one of three categories:

- Lifestyle Purchase: A second home or residence with resale appeal (sea views, terraces, smart-home systems). Return = lifestyle.

- Hybrid Use: A blend of personal enjoyment with rental income, depending on licensing. Typical yields: 4–5% gross.

- Yield-Focused Investment: Apartments or compact villas in high-demand areas, fully optimized for rentals with professional management.

Risks & How to Mitigate Them

Even prime markets require careful due diligence:

- Licensing & Compliance: Verify ETV (holiday rental) licences and Licencia de Primera Ocupación.

- Community & Maintenance: Review homeowners’ association (HOA) documents, reserve funds, and planned works.

- Property Condition: Commission a technical survey; budget 5–10% of purchase price for upgrades.

- Micro-Market Pricing: Compare recent sales €/m²; avoid hype-driven pricing.

- Currency & Financing: Non-Euro buyers should consider FX strategies and Spanish mortgage options.

Returns: What to Expect

- Capital Growth: Prime areas have achieved 7–9% annual appreciation in recent years, with eco-luxury villas outperforming.

- Rental Yields: Long-term leases in Palma average 4–5% gross; licensed short-term rentals can reach 5–7% gross.

- Holding Period: Optimal time frame is 5–10 years due to Spain’s transaction costs.

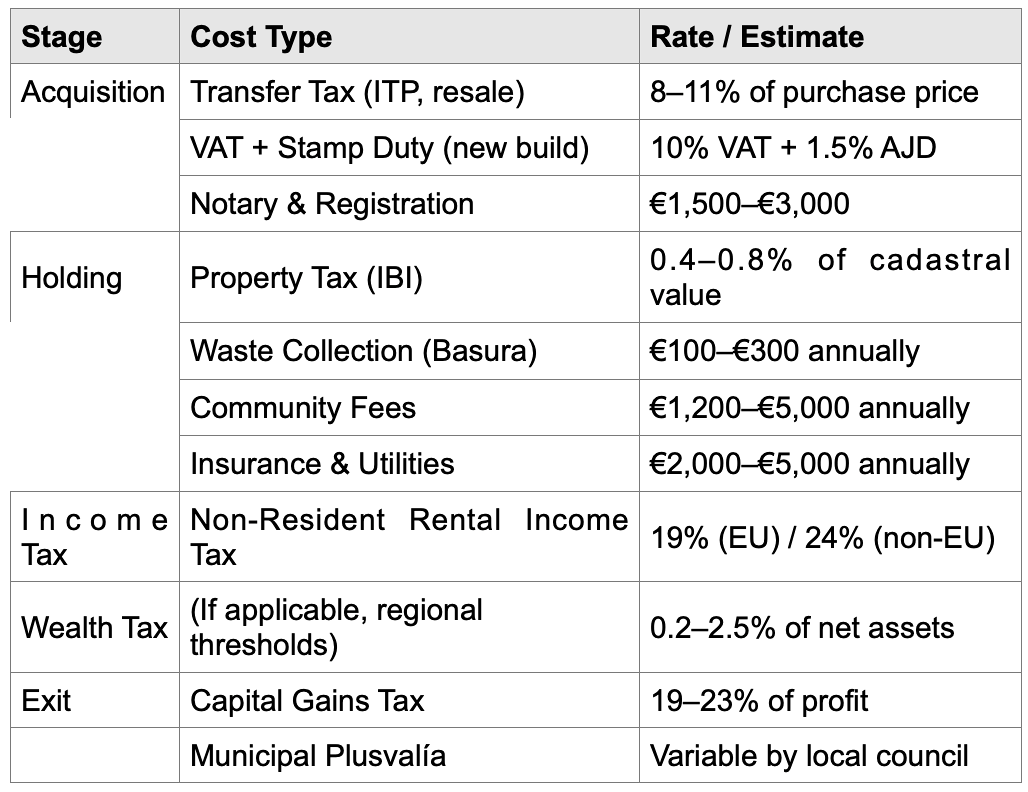

Costs & Taxes to Consider

Typical expenses include:

- Transfer Tax (ITP): 8–11% on resales.

- VAT + Stamp Duty: 10% + 1.5% on new builds.

- Community Fees: €1,200–€5,000 annually.

- Property Tax (IBI): 0.4–0.8% of cadastral value.

- Rental Income Tax: 19% (EU) / 24% (non-EU).

Where to Buy: Key Micro-Markets

- Son Vida: Prestigious golf community above Palma; villas €6,500–€9,000/m².

- Portals Nous & Old Bendinat: Blue-chip marina lifestyle; seafront apartments €7,500–€12,000/m².

- Port d’Andratx: Trophy villas with sunset views; €9,000–€13,000/m².

- Santa Ponsa: Family-oriented with golf and schools; €5,000–€7,000/m².

- Palma City: Lock-up-and-leave apartments; €6,000–€9,000/m².

- Inland Villages: Pollensa, Sóller; €2,200–€9,600/m² with rising remote-worker demand.

Future-Proofing: Sustainability & Liquidity

Buyers increasingly value properties with eco-credentials: solar, insulation, EV charging, and A/B energy ratings. These features command premiums and reduce operating costs.

Exit strategies also matter: staging, professional marketing, and international networks ensure liquidity when reselling.

Case Studies: Real Investors, Real Results

London Family in Santa Ponsa: Hybrid villa, net yield of 3.2%, running costs reduced by 35% after solar installation.

Munich CEO in Palma: Cathedral-view penthouse, €1,200/night in peak season with 5% yield.

Zurich Investor in Son Vida: Sustainable refurbishment increased property value by 12% in 18 months.

Conclusion

Mallorca remains one of Europe’s safest and most rewarding real estate markets for investors seeking both stability and lifestyle. With meticulous due diligence, the right licensing, and a clear strategy, investors can secure not only solid returns but also an enviable Mediterranean lifestyle.

For personalized advice on investing in Mallorca real estate, contact Homerun Brokers today.